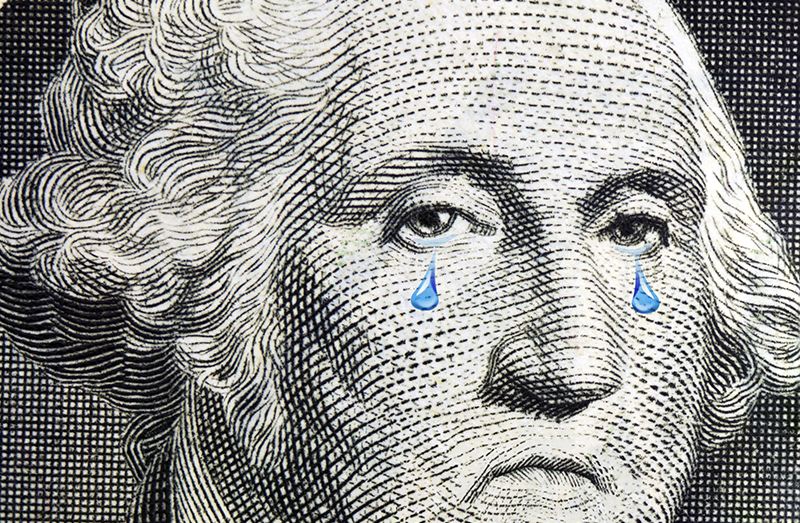

High stock market prices have fooled many people into thinking that the economy is doing just fine, even though thats not really the case. Economic productivity is still only increasing slightly. And the lowering unemployment rate is more the result of people continuing to leave the workforce than it is the result of the creation of new jobs. For workers who are employed, wage growth has been largely stagnant for years. So if stock markets arent a good indicator of the direction of the economy, what is?

The US dollar index is perhaps one of the lesser-publicized economic indicators in mainstream financial media, but its followed closely by seasoned precious metals investors. The index tracks the dollars strength against a basket of currencies. A decline in the dollar index indicates a weakening dollar, while an increase indicates a strengthening dollar.

Declines in the dollar index are often correlated with weakening economic conditions. The index reached its all-time lows in early 2008, just a few months before the financial crisis hit. The dollar index is currently trading around 93 to 94, up from its low in the 91s in September. Many commentators are calling the current mini-rally a dead cat bounce, however, as the dollar has declined significantly from its highs around 103 at the beginning of the year.

It shouldnt be surprising to see the dollar continue to fall as the year progresses. Thats particularly true given the fact that President Trump has nominated Jay Powell to be the next Chairman of the Federal Reserves Board of Governors. His conduct of monetary policy shouldnt be expected to be much better than that of Janet Yellen, so be prepared to expect more loose monetary policy in the years to come.

Overheated stock markets and a declining dollar index are both leading indicators of a coming market crash and a likely financial crisis. And when that crisis comes, dont be surprised to see the Fed leading the way with more quantitative easing, just like it did during the last financial crisis. The Fed only knows how to do one thing, and that is to create money out of thin air. Its solution to every problem is more liquidity.

That will continue to drive down the dollar and diminish its purchasing power. Thats why watching the dollar indexs movements now can provide useful clues about the coming crisis. Investors who are heavily invested in dollar-denominated assets risk large losses when the financial crisis hits. Thats why smart money moves into gold and precious metals before the crash, to take advantage of golds ability to protect wealth and assets. Make sure that you take the right steps to secure your assets before the crash comes because afterward, it will be too late.

The post Watch the Declining Dollar appeared first on Goldco.

No comments:

Post a Comment